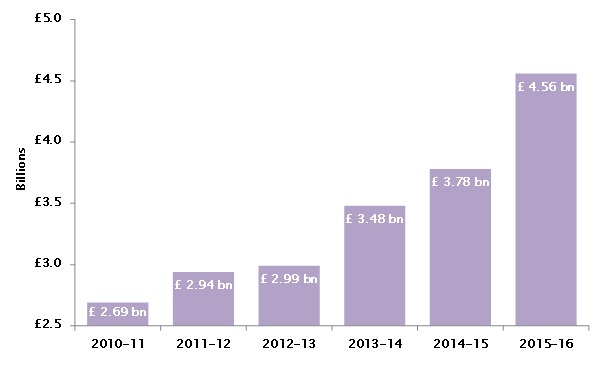

HMRC Inheritance Tax take jumps 21% to a record-high £4.6 billion in a single year

23 March 2016

Inheritance tax (IHT) receipts taken by HM Revenue and Customs (HMRC) jumped to a record-high £4.6 billion in 2015-2016*, up 21% from £3.8 billion a year earlier says Wilsons, the leading private client law firm.

Wilsons adds that the £4.6 billion collected by HMRC in the last year is an increase of 70% from 2010-11 when the total amount raised was just £2.7 billion.

Wilsons explains that a major driver of the increase in inheritance tax (IHT) revenue is that more estates are being caught in the ‘IHT net’ as property prices rise. The current threshold, after which estates are subject to IHT, has remained at £325,000 since 6 April 2009.

Tim Fullerlove, Partner and trusts and tax specialist at Wilsons, comments: “Inheritance tax was originally intended as a tax on the very wealthy, but it has now become a general tax for a large proportion of the middle classes.”

“With the increasing value of property, it is no longer just the large windfalls of inheritance from estates that are being taxed.”

“As the threshold has stayed at a fixed rate for almost seven years, individuals who were not originally intended to be taxed are now facing significant bills because of the rise in property prices, particularly in London and the South East of England.”

Wilsons says that, despite the record IHT take, the Government has recently announced plans to introduce new dramatically-increased probate fees that would mean estates worth over £2 million would pay £20,000 for undergoing a probate instead of the current £215.

Tim Fullerlove says: “Despite HMRC taking a record figure from inheritance tax over the last year, the Government wants to further boost its revenue and is now planning to raise probate fees.”

“The planned new fees do not reflect any real difference in the costs to the probate service of handling probate on a large or small estate. In effect, they amount to an additional inheritance tax on larger estates”

Wilsons points out that the Government is introducing a new main residence nil-rate band for the primary residence when it is bequeathed to a direct descendant. This new band will add an extra £100,000 to the threshold in 2017, and by 2020 will add £175,000. This band will gradually bring the threshold to £1 million for married people, with certain conditions. However, these measures will do less for childless couples and individuals who have never owned their own property.

Amount of Inheritance Tax taken by HMRC jumps to record £4.56 billion

For further information please contact Tim Fullerlove